From Chris Cervisi

Opportunity in the Real Estate Credit Market

Buchanan’s foundation is rooted in real estate credit. Since 1999, we have closed 94 debt investments totaling more than $1.3 billion. Lending has been a complementary business line to our equity funds providing us a differentiated viewpoint as both a lender and operator. Consequently, our longstanding presence in the CRE lending landscape affords us a unique perspective on the current state of capital markets. Specifically, we’d like to address some of the CRE news headlines and offer strategies for risk mitigation.

As an investor and market observer, you’ve probably seen these types of recent headlines:

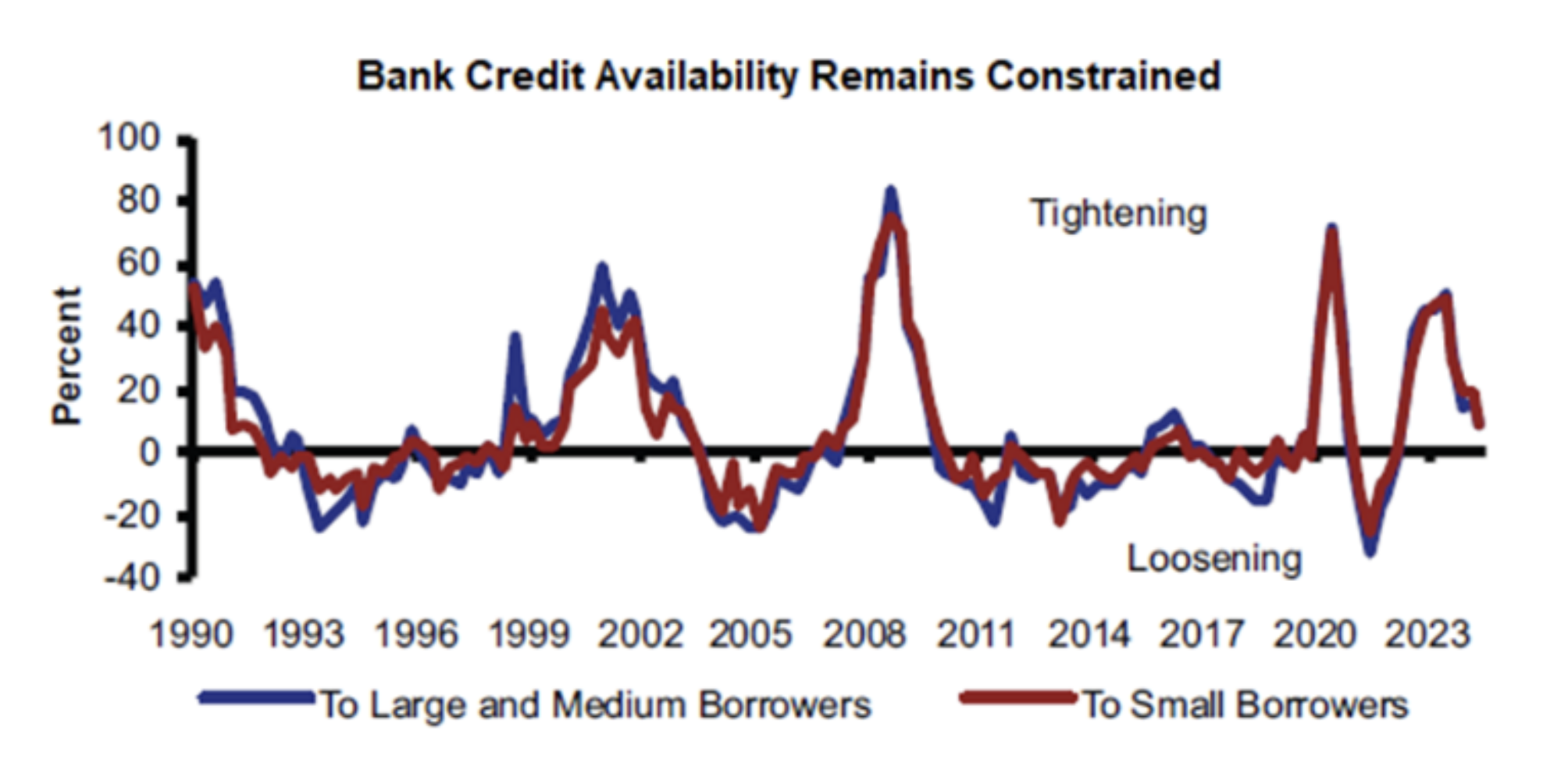

A confluence of macroeconomic factors has created a once-in-a-decade repricing of assets. According to the Green Street all-property CPP Index, property values declined 20% from their 2022 highs. Many loans originated in 2021-22 are likely to experience stress as some of those borrowers have lost most of their equity, in some cases all of it. Cap rates have normalized off their pandemic lows and lenders are facing challenges as borrowers struggle to refinance maturing loans. Elevated interest rates are reducing cash flow, forcing property owners to inject additional equity to meet capital requirements upon refinance. The sustained adoption of remote work continues to disproportionately impact office buildings. Compounding these challenges, regulatory factors are prompting bank lenders to curtail their commercial real estate exposure, especially in the office sector. Historically, banks have been the dominant source of CRE financing. For well-capitalized, non-regulated lenders this presents the opportunity to realize outsized returns going forward as traditional financing sources move to the sidelines.

It’s important to cut through the noisy headlines and address manageable market risks firsthand.

What underlying factors are omitted from these prevailing narratives and how can lenders protect their balance sheets and mitigate downside risk? Further, what strategies should lenders adopt to capitalize on periods of distress in the market? Let’s address these one at a time.

What underlying factors are omitted from these prevailing narratives?

The banking industry is much better capitalized today than before the Global Financial Crisis, making them more resilient to potential loan losses. They remain a key financing source for CRE owners and lenders however they are strategically scaling back exposure to “less-capable” borrowers.

Coupled with this, interest rates are on a downward trajectory, with the 10-year US Treasury rate falling from 5.0% in late 2023 to 4.2% today.

This decline, along with anticipated further rate cuts, is relieving some of the pressures of high interest rates.

Notably, market fundamentals for industrial, self-storage, retail, and multifamily properties have returned to levels consistent with historical averages observed prior to the pandemic, after experiencing tremendous growth. The prevailing trend over the past two years has been a normalization of market conditions. Specifically, abnormally high rent growth has moderated as record amounts of new supply of multifamily and industrial buildings are being delivered.

In the face of normalizing market conditions, projections suggest that new apartment supply will begin to decline significantly by late 2025 and continue to do so into 2026. This trend is evidenced by the 40% decrease in construction starts in 2023 compared to 2022, as well as ongoing declines in building permit volumes in 2024. Despite all the recent new supply, Linneman Associates project a shortage of 767,000 units by year-end 2025, which is expected to increase through at least 2027. We believe these factors will lead to strong occupancy rates and rental growth in the coming years.

Furthermore, property values appear to have stabilized, with the Green Street all-property index even increasing by 3.0% year-to-date. There are almost record levels of dry powder awaiting deployment which should reinforce a stable baseline for property prices going forward.

On the flip side, office buildings have become a four-letter word for most investors and lenders as remote work has caused many companies to downsize their existing space requirements. While this trend has significantly impacted values for older office properties, the best of the best Class AA buildings in prime locations with top of market amenities are still commanding strong and sometimes increasing rental rates due to tenants’ seeking top quality space in order to attract and retain top talent. Smart lenders should be focused on this type of office product.

As you can see, challenges persist but maintaining a balanced perspective and adapting to ongoing market shifts is crucial. Successfully navigating these complexities requires a strategic approach to risk management.

So how can lenders protect their balance sheets and mitigate downside risk?

To mitigate risk, it is imperative to maintain substantial liquidity and prudent balance sheet leverage. The ability to solve problems vs. just kick the can down the road is critical. Furthermore, long-standing relationships with investors and lenders, coupled with timely, accurate and transparent reporting, are crucial.

Additionally, proactive communication with borrowers is vital, especially when anticipating potential challenges such as project delays, cost overruns, and changes in market conditions. By dealing with problems early, experienced lenders can help borrowers solve problems before they become insurmountable.

Lenders with operating experience can tap into a wider established network of real estate professionals providing better understanding of local market trends. By utilizing in-house equity expertise to anticipate problems, you can approach difficult borrower situations from a position of strength and optimize asset performance, even in the event of foreclosure.

Finally, it’s important to periodically re-underwrite assets, and borrowers, to determine if the fundamentals of a transaction have materially changed. For example, has the borrower suffered distress on other assets that could impair their ability to access liquidity in the event it’s required? Many borrowers haven’t suffered distress like this in 15 years, if ever, and therefore may not be adequately prepared to deal with their own distress. Moreover, many lenders lack in-house workout expertise, limiting their ability to effectively manage distressed assets. When reassessing existing loans, the borrower’s capacity to execute the remaining, and often revised, business plan is of utmost importance. Distressed borrowers can significantly diminish property value if they lack capital, expertise, or incentives to maximize the property’s value.

These are just a few risk management principles essential for weathering market storms, but it is equally important for lenders to capitalize on opportunities that arise during periods of distress.

What strategies should lenders adopt to capitalize on periods of distress in the market?

Focus on originating loans for borrowers with strong liquidity and a proven track record of success with their contemplated business plan through multiple economic cycles.

Sponsor balance sheets, and contingent liabilities, should be thoroughly scrutinized. Are they capable of executing the business plan on a predictable timeline? Ensure the borrower possesses the necessary skills and financial resources to address challenges independently. Underwrite new loans conservatively; this typically includes scaling back aggressive market rent assumptions and project timelines creating a margin of safety. Further, identify sponsors with investor-aligned economic incentives. For example, is the sponsor/GP contributing material equity vs. just raising it from third parties?

Additionally, it’s important to focus on well understood property types with a clear understanding of current valuations as supply/demand fundamentals can change rapidly. Moreover, there should be a focus on familiar markets where the team has strong relationships and historical insights. These key industry partners should already be familiar with lender capabilities, providing early access to deal flow.

In conclusion, we believe risk management is a top priority during periods of distress to ensure long-term success. Investment firms with a proven track record spanning multiple market cycles, acting as both lenders and operators, possess a unique ability to identify market challenges and opportunities much earlier. Firms that actually own and operate property have access to real time information, providing much better opportunity to minimize downside risk while identifying new investment opportunities reflective of current market realities.