Prudence dictates that we prevent our industry from going backwards and losing the credibility that we have worked so hard to gain.

By: Robert Brunswick

Real estate development in the U.S. has historically been driven by entrepreneurs with great ambition and visions of grandeur, but thin pocketbooks. Lacking their own controlled or discretionary capital, these developers needed to sell their ideas to banks, pension funds and other investors. This reality dictated more leverage, as equity was expensive and diluted the entrepreneur’s take-home profit. This was never more evident than in the 1980s-1990s when the S&L industry often provided close to 100 percent loan capitalizations. We all know how that played out, with a crashed real estate industry starved for the equity capital it was missing in the first place.

Today’s real estate industry has joined other institutional asset classes with improved discipline, protocol and process as demanded by both investors and regulators. Public debt and equity, an educated workforce, and transparent and standardized reporting all have enhanced capital’s confidence in real estate as an asset class. Investors’ real estate appetites have been further buoyed by their need to access alternative investments and the cashflow predictability of real estate in a yield-starved environment.

The Financial Crisis of 2008-2009 set in motion another factor that is very influential in today’s evolved real estate market – a greatly enhanced regulatory regime. Many industry participants would argue that such regulation has overshot its target, as is often the case in these dramatic cycles, thereby reducing leverage with more restrictive underwriting protocols for the banking industry. The benefit to those of us who invest in real estate, however, has been a marketplace that now requires, broadly speaking, more equity to satisfy the lenders’ current playbook. Aside from the benefits of a more prudent investment balance sheet, higher equity requirements have also boxed out less capable and undercapitalized players from participating in the industry. This new, less-levered real estate world was then further buttressed by a lack of yield in other conventional asset classes such as bonds and equities, prompting more capital flows to real estate given its comparatively favorable yield proposition.

Increased capital flows have naturally translated into property price appreciation and significant cap rate compression. We must ask whether real estate is overpriced, and whether investors should seek more leverage to offset this yield erosion. We are now seeing a partial rollback of the Dodd-Frank regulations, allowing community banks more lending flexibility. While we all would like to attain more yield, we should stay disciplined and realistic as to these trade-offs. Prudence dictates that we prevent our industry from going backwards and losing the credibility that we have worked so hard to gain.

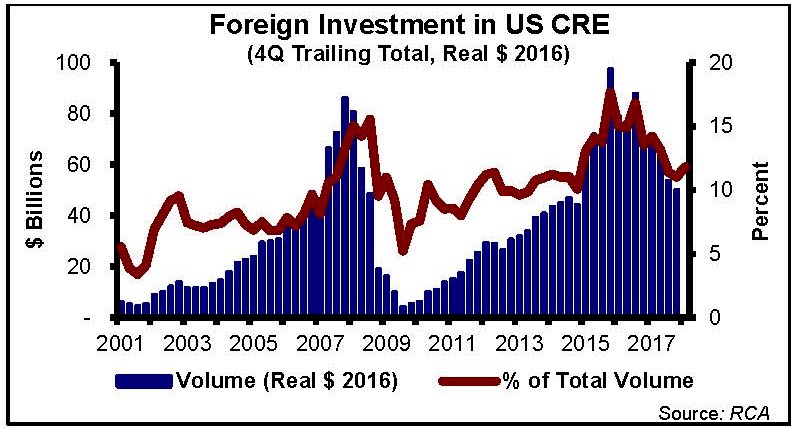

The equity well is deeper than it’s ever been, with global dry powder for closed-end private real estate funds at their highest point in history. Foreign investment remains robust as many offshore investors seek the safe haven and favorable cash flow of U.S. commercial real estate. These trends bode well for our collective “sleep at night” quotient as we reassess the continual tussle between fear (more equity) and greed (more debt). Given our still fresh collective memories of 2009-2010 and our current stage in the property cycle, fear seems to be maintaining a slight edge…as it probably should.

Robert Brunswick is the co-founder and CEO of Buchanan Street Partners, a real estate investment management firm that focuses on real estate investing through direct acquisition of commercial and multifamily properties in addition to originating and funding debt for third-party owners of real estate.

###